Merchant Cash Advance

A merchant cash advance is a great way to borrow money if your business processes credit or debit card payments and you are looking for a fast cash loan with flexible repayment terms.

What is a merchant cash advance?

A merchant cash advance allows you to borrow money based on future credit and debit card sales. It gives you the opportunity to tap into future sales, boosting your immediate cash flow.

Also called a business cash advance, this type of finance is a great option for companies with few assets or a limited credit history. It is particularly used by companies in the hospitality, retail and leisure sectors that have a high volume of card sales.

You will not have to put up any assets as security against the loan, which gives many borrowers peace of mind.

Merchant cash advance is very different to other forms of finance because the loan repayments are dependent on the strength of your sales, which is a great help during periods of poor trade.

Below we explain how they work in more detail.

How a merchant cash advance works

A merchant cash advance allows you to borrow money based on future credit and debit card sales. It gives you the opportunity to tap into future sales, boosting your immediate cash flow.

Also called a business cash advance, this type of finance is a great option for companies with few assets or a limited credit history. It is particularly used by companies in the hospitality, retail and leisure sectors that have a high volume of card sales.

You will not have to put up any assets as security against the loan, which gives many borrowers peace of mind.

Merchant cash advance is very different to other forms of finance because the loan repayments are dependent on the strength of your sales, which is a great help during periods of poor trade.

Below we explain how they work in more detail.

Thoughts from Matt

“A merchant cash advance is a very different proposition to a typical loan product – the main difference being there is no end date to repaying the loan. You simply pay according to the strength of your sales.

As a borrower, you get peace of mind knowing you will not have to keep up with fixed repayments if business is slow.

You can only take out this loan if you take regular card payments from customers. Talk to us today about how much your business could borrow and you could receive your funds within days.”

Matt Haycox

Founder and CEO, Funding Guru

How much can I borrow?

The amount you can borrow through a merchant cash advance will be influenced by your sales and business activity. At Funding Guru, we typically lend between £10,000 and £500,000.

Because of the nature of this type of loan, we do not charge late payment charges as there is no end date on the loan term. The agreement ends when we have received the money owed to us.

We can typically have the funds in your account within three business days, once your application for a merchant cash advance has been accepted.

We accept applications from both sole traders and limited companies.

What can a merchant cash advance be used for?

A merchant cash advance can be used for any business purpose, such as the below:

Buying stock

Paying suppliers

Paying tax bills or other bills

Refurbishments

Marketing activities

Does my business qualify for a merchant cash advance?

A merchant cash advance can be used by a wide range of businesses across different sectors. Examples of businesses using this type of loan include hotels, restaurants, cafes, along with online and high street retailers.

As a lender, we will want to see:

- You have been operating for at least six months

- Average monthly card sales of £2,500 plus

- Three months of card statements

- Three months of business bank statements

Pros of a merchant cash advance

There are many benefits to a merchant cash advance if you are looking to borrow money.

Merchant cash advance is a form of unsecured business loan, so you will not have to worry about putting up assets as collateral to secure the loan.

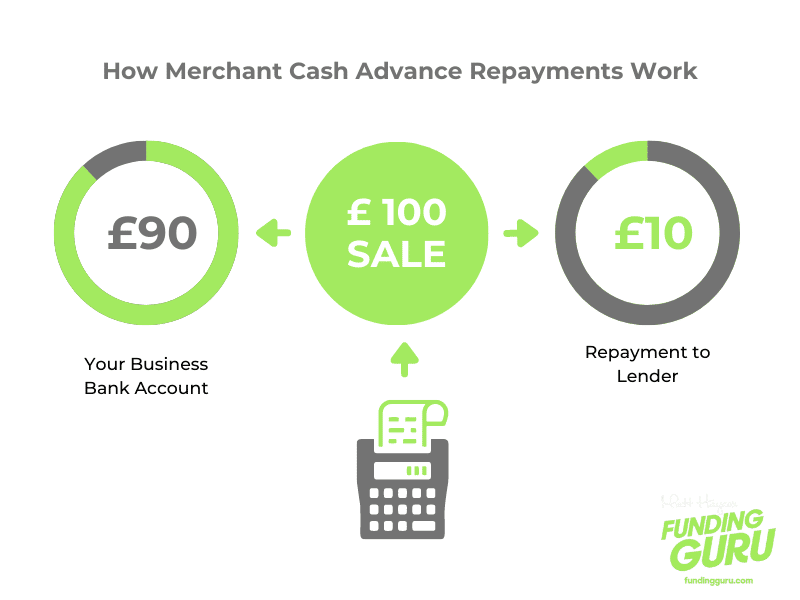

Sales slower than usual? The amount you repay to the lender will also fall as the money is repaid through a percentage of each sale.

As long as you meet the qualifying criteria (such as having strong debit and credit card sales), it’s easy to set up. You’ll get the upfront cash within a few days.

Because of the nature of the loan, the risk of defaulting is lower because the repayments are a proportion of your sales so your cash flow won’t be too impacted by the repayments.

We are upfront about our charges from the outset. You will not be sting by any hidden fees or charges.

The loan repayments are automatic as the card terminal provider pays the lender directly, so you don’t have to worry about arranging the repayments yourself.

Cons to a merchant cash advance

While there are many good points of a merchant cash advance, you should also consider the potential cons listed below.

You can only take out a merchant cash advance if you have strong credit and debit card sales, so not all businesses will qualify for this form of finance.

They are more expensive than other types of loan. This is because we, the lender, do not get the certainty of fixed regular repayments and there is no security or collateral against the loan.

Like all borrowing, there is a risk your business becomes too reliant on loans. Because you will be paying fees and interest, your profit margins will be reduced and in the long-run your business may not be viable.