Can a business take out a mortgage? The answer is yes, but securing a business mortgage involves different eligibility criteria, interest rates, and repayment terms than personal home loans.

In this guide, we’ll explore how businesses can access property financing, whether you need a business loan to buy property, or a commercial mortgage. If you’re looking for ways to secure funding for your business premises, read on

What Is a Business Mortgage?

A mortgage is a loan toward the cost of a property. The business must use the property for wholly business purposes.

A business can use a mortgage to:

- Acquire a property.

- Refinance a property (to replace an existing mortgage, or to cash out a portion of equity).

- Redevelop a property.

Many people also ask “can a business get a residential mortgage?”. The answer is yes, as long as you use the residential property for commercial purposes.

So if you want to borrow toward the cost of an apartment complex with the view to generate rental income, a commercial mortgage is a suitable option.

If you want to borrow through your business to finance the purchase of your personal home, however, this is not possible.

What Can a Mortgage Do for Your Business?

A business mortgage can deliver several benefits to your business:

- At the end of the mortgage period, your business will own the property.

- While paying off the mortgage, you’ll be working towards ownership, rather than putting your money in a landlord’s pockets.

- The total spent on mortgage interest will be lower than what you’d have spent on rent in an equivalent period.

- You can release equity from the mortgage when required by refinancing.

- The property’s value may increase. In this case, the value of your investment rises as well. When renting, the increased property value would result in greater repayments, which would disadvantage you while benefitting the landlord.

- Financial forecasting becomes simpler with a mortgage because repayments are less prone to variation than rent.

Also, interest rates for commercial mortgages are usually low than other types of business finance, thanks to the high value of the property the loan is secured against.

How to Qualify for a Business Mortgage?

To secure a business mortgage, lenders assess several factors, including:

- Business Credit Score: Lenders prefer businesses with a strong credit rating, typically above 700.

- Trading History: Most lenders require at least two years of profitable trading records.

- Deposit Requirements: A commercial mortgage usually requires a minimum 20-30% deposit.

- Loan-to-Value Ratio (LTV): The lower the LTV, the better the loan terms.

- Business Profitability: Lenders evaluate net profit margins to determine affordability.

Tip: If your business lacks trading history, consider a business loan to buy property instead of a traditional mortgage.

What Types of Commercial Mortgages Are There?

There are several types of property finance, from the simple commercial mortgage through to more elaborate options designed to target specific situations.

Commercial mortgages

This type of finance is a loan secured against a property which will be used solely for business activities, or which represents a business in its entirety.

Commercial mortgages are a great choice if your business wants to transition away from leasing their premises, or if you’re looking to establish a buy-to-let business model.

A business can also take out a mortgage on all or part of a property they already own to unlock the capital it represents – referred to as ‘refinancing’.

Portfolio finance

Whereas a commercial mortgage sees a loan secured against one property, portfolio finance allows you to borrow against two or more properties.

The cash borrowed can be used to acquire more property, develop one or more of the properties within the portfolio, or just to free up some of the capital locked inside.

Because the value of the portfolio is high, portfolio finance usually offers lower interest rates than commercial mortgages.

Bridging loans

If you need short-term finance to bridge the gap between acquiring new property and being approved for a mortgage that entirely covers its cost. Equity in a property you already own is unlocked and used as a down payment for another purchase.

Whereas mortgage terms can span several decades, the upper limit for bridging finance is usually one year. Learn more about bridging loans here.

Development finance

This type of loan is for businesses who want to develop a new property or redevelop an existing property. Terms are tailored toward this outcome and will differ slightly than if you were to borrow the equivalent amount through a commercial mortgage. Learn more about development finance here.

Mezzanine finance

This funding type is a hybrid of debt and equity finance and tops up funding shortfalls on high-cost property projects. If you’ve secured the majority of the investment you need through a mortgage, mezzanine finance could provide the remainder of what’s required to get the project over the line.

How to Get a Business Mortgage?

Securing a business mortgage can be a smart move if you’re looking to purchase commercial premises instead of leasing. Whether you’re planning to buy an office, shop, warehouse or other commercial asset, here’s a step-by-step guide to getting a business mortgage in the UK.

1. Assess Your Requirements

Start by determining:

-

The type and location of property you want to buy

-

How much deposit you can provide (typically 20–40%)

-

Your monthly repayment budget based on current cash flow

2. Check Your Eligibility

Lenders will look at several factors:

-

Your business’s trading history (usually 2+ years)

-

Company credit rating and director credit profiles

-

Business structure (limited company, sole trader, partnership)

-

Affordability – profits must support the mortgage repayments

3. Get a Property Valuation

Most lenders will require a formal property valuation to assess:

-

Market value

-

Condition and future potential

-

Suitability for commercial use

4. Prepare Your Documents

You’ll need:

-

2–3 years of business accounts

-

Bank statements

-

Proof of ID and address

-

Business plan or forecast (if applying as a new venture or start-up)

5. Apply Through a Lender or Broker

You can apply directly with commercial mortgage lenders or work through a broker who has access to a wider panel. A broker can help match you with lenders that are more flexible or niche.

6. Undergo Affordability & Risk Checks

Lenders will conduct:

-

Credit checks (both business and directors)

-

Affordability analysis (profit/loss, debt service ratios)

-

Legal checks on the property

7. Receive an Offer & Complete

If approved, you’ll receive a mortgage offer. Once legal due diligence is complete (including searches and contracts), funds are released and you complete the property purchase.

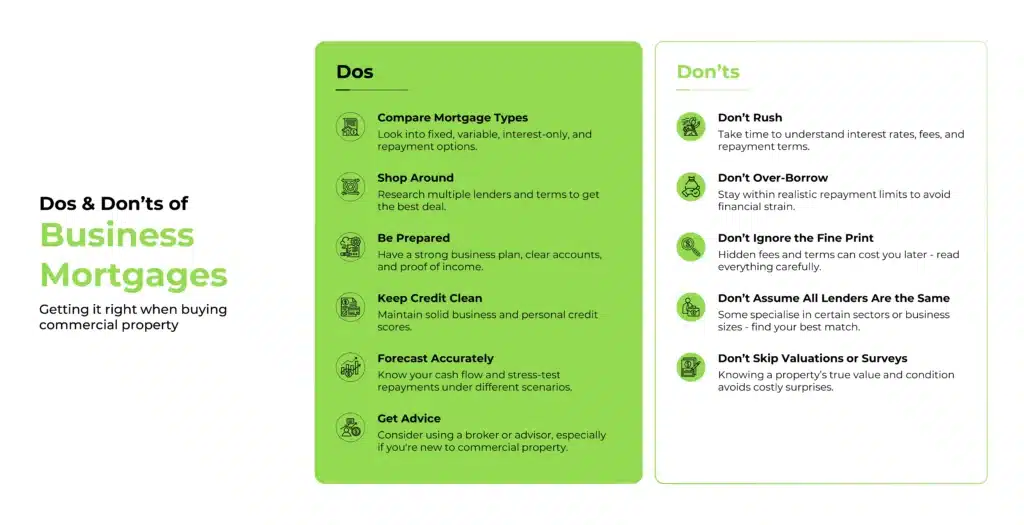

The dos and don’ts of business mortgages

There are some key dos and don’ts when taking out a business mortgage.

-

Do research on different types of commercial mortgages.

-

Do look for the best possible mortgage for your need by researching lenders and terms.

-

Do prepare to meet the lender’s requirements with a solid business plan, clear financials, and proof of cash flow.

-

Do maintain a good credit rating to increase your chances of approval.

-

Don’t skip over the fine print or rush the process. Compare the interest rates, and payback schedules.

-

Don’t over burden your business by borrowing more than you can afford to realistically pay back.

How does a business mortgage compare to a personal mortgage?

A business mortgage and a personal mortgage differ in several key ways:

| Feature | Business Mortgage | Personal Mortgage |

|---|---|---|

| Purpose | Buying commercial property for business use | Purchasing a home for personal use |

| Deposit Required | Typically 20-40% | Usually 5-15% |

| Interest Rates | Generally higher than personal mortgages | Lower due to reduced risk |

| Loan Terms | Typically 5-25 years | Usually 15-30 years |

| Eligibility Criteria | Based on business finances, revenue, and credit | Based on personal income and credit history |

| Lender Options | High street banks, specialist lenders | Banks, building societies, mortgage brokers |

If you run a limited company, some lenders allow a business mortgage to be taken in the company’s name, helping to separate personal and business finances.

Case Study: How One Business Secured a Commercial Mortgage

Jane, the owner of a growing e-commerce company, wanted to purchase a warehouse to streamline logistics.

With a £200,000 deposit and a solid financial history, she secured a £500,000 mortgage with an interest rate of 4.5%. By owning her premises instead of leasing, she saved £1,500 per month compared to her previous rental costs.

Key Takeaways:

- A strong credit score and financial history can secure better interest rates.

- Owning a business property can be cheaper than renting over time.

- Specialist lenders can provide more flexible terms for SMEs.

Conclusion

To sum up, a business mortgage can help you to finance the acquisition of one or more properties that you’ll use for commercial purposes.

This could be office space where your primary business activities will take place, or it could be an apartment complex intended to generate rental income of its own.

Other types of commercial property finance exist, too. They can help you to fund development, to bridge temporary finance shortfalls, or to top up funding gaps.

Applying for a business mortgage is easy, but not all business owners meet the criteria required.

Funding Guru prides itself on taking into account the plans of a business, as well as its history – so if you’re a business owner struggling to get a commercial mortgage, get in touch.

FAQs

Can a startup get a business mortgage?

Yes, but it’s more challenging. Startups usually need a larger deposit (30-40%) and personal guarantees to secure a loan. Alternative funding, such as secured business loans, may be more accessible.

Is a business mortgage cheaper than renting?

In the long term, yes. While the initial costs of buying commercial property are higher, monthly mortgage payments are often lower than rental rates, especially in high-demand locations.

How much deposit do I need for a business mortgage?

Most lenders require at least 20-30% of the property’s value as a deposit. However, for riskier businesses or those with limited trading history, this can increase to 40% or more. If you have a lower deposit, consider alternative financing options like a secured business loan or bridging loan.

Is a business mortgage different to a commercial mortgage?

Yes, a business mortgage and a commercial mortgage are essentially the same thing. Both terms refer to a loan secured against a property that is used for business purposes. Some lenders might use “business mortgage” when referring to smaller businesses and “commercial mortgage” for larger, more complex deals, but in practice, the products are very similar. They can be used to purchase new premises, refinance an existing property, or release equity from owned property.

How hard is it to get a business mortgage?

Getting a business mortgage can be more challenging than securing a residential mortgage. Lenders assess the financial health of your business, including your profit and loss statements, cash flow, and future forecasts. They will also consider your credit history, the nature of your business, and the value of the property being mortgaged. To improve your chances, prepare detailed financial records and have a strong business plan showing how you intend to repay the loan.

Can you use a business loan to buy property?

Yes, it is possible to use a business loan to buy property, but it is less common than using a dedicated business mortgage. Business loans are usually unsecured or short-term finance, while mortgages are designed specifically for property purchases and tend to offer lower interest rates over longer repayment terms. If you’re considering buying property, a commercial mortgage will typically be a better and more cost-effective solution.